does the irs write off tax debt after 10 years

Get the Help You Need from Top Tax Relief Companies. BBB Accredited A Rating - Free Consult.

What Is The Irs Debt Forgiveness Program Tax Defense Network

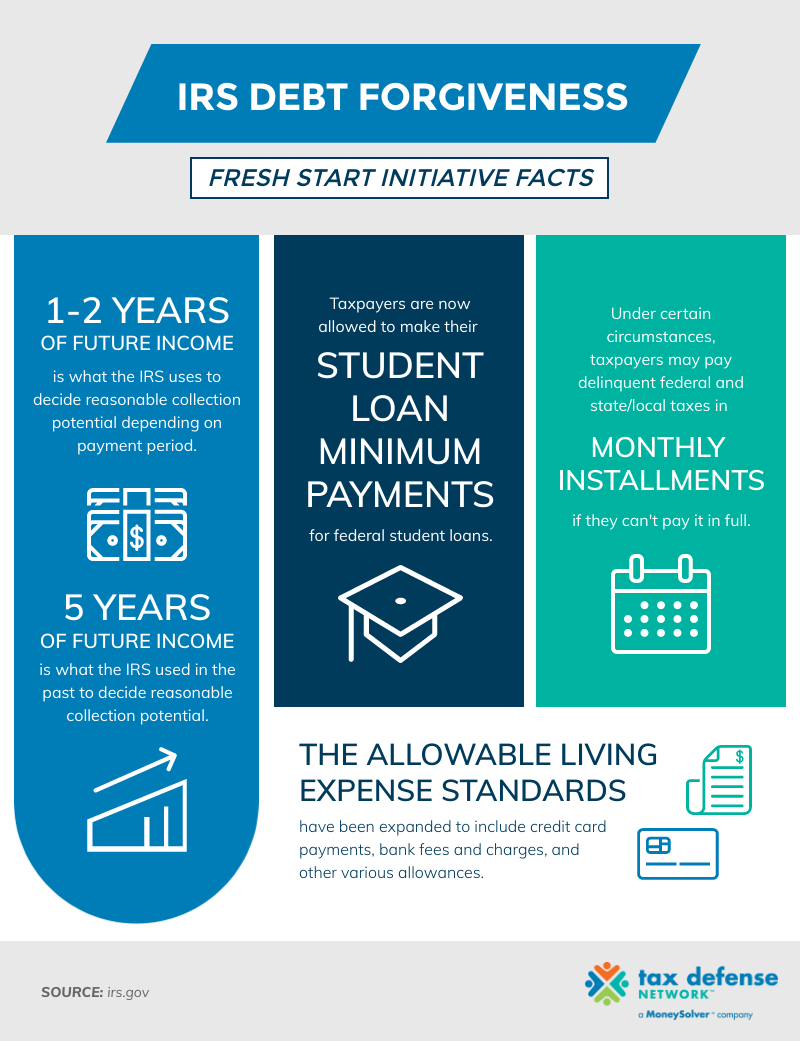

This is called an offer in compromise or OIC.

. How long can the IRS collect. The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. If you prove to the IRS this is the first time you have been in a.

This means the IRS should forgive tax debt after 10 years. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of limitations on. Limitations can be suspended.

After that the debt is wiped clean from its books and the. End Your IRS Tax Problems. Does the IRS forgive back taxes after 10 years.

Unfiled Tax Return Help. As already hinted at the statute of limitations on IRS debt is 10 years. Does IRS tax debt go away after 10 years.

Resolve Your Tax Issues Today. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. For example if your tax debt is 10000 and you offer them 5000 in an offer in compromise they will consider it.

Ad Need help with Back Taxes. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. In this event the.

This is called the 10 Year. Unfortunately that 10-year timeline is. Get A Tax Analysis Consultation.

Many people feel tempted to wait out the 10 years to not pay the debt. Does the IRS Forgive Tax Debt After 10 Years. Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of.

Start with a free consultation. Does IRS forgive debt after 10 years. As a general rule of thumb the IRS has a ten-year statute of limitations on IRS collections.

The IRS contacting you can be stressful. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. After that the debt is wiped clean from its books and the IRS writes it off.

After that the debt is wiped clean from its books and the IRS writes. However some crucial exceptions may apply. If this is the first time youve owed the IRS money you can request a first-time abatement.

However the waiting it out strategy is. Generally under IRC 6502 the IRS will. The day the tax debt expires is often referred to as the.

Ad A Tax Advisor Will Answer You Now. The IRS generally has 10 years to collect on a tax debt before it expires. After that the debt is wiped clean from its books and the IRS writes it off.

12 Years In Business. If you prove to the IRS this. As already hinted at the statute of limitations on IRS debt is 10 years.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. Compare 2022s 10 Best Tax Relief Companies. Its not exactly forgiveness but similar.

Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. Ad You Dont Have to Face the IRS Alone. We work with you and the IRS to settle issues.

Generally speaking the Internal Revenue Service has a maximum of ten years to collect on unpaid taxes. Ad As Heard on CNN. The Internal Revenue Code.

When the ten years are up the IRS is required to write the debt off as a bad debt essentially forgiving it. If accepted by the IRS then that means that once you pay off. After that time has expired the obligation is entirely wiped clean and removed from a.

Ad End Your IRS Tax Problems. The Collection Statute Expiration Date CSED is the date ten years from when the tax got assessed and when the IRS writes off the debt. After 10 years the IRS can write the debt off and clear it from their books.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

As seen on CNN NBC ABC and CBS. Does the IRS write off tax debt after 10 years. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

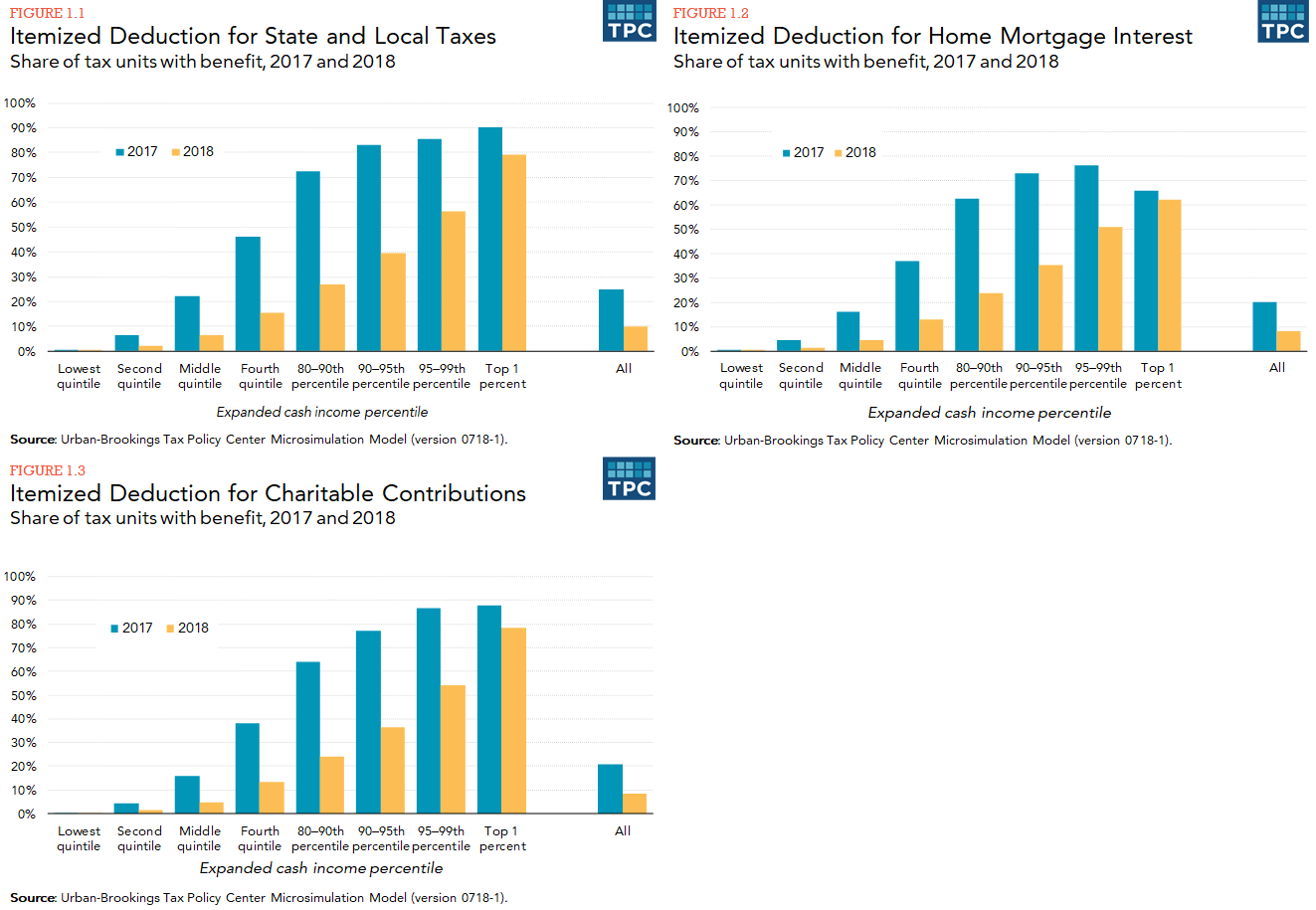

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

The Tax Help Guide Ultimate Resource For Tax Help Questions

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Can The Irs Collect On A 10 Year Old Tax Debt

Are There Statute Of Limitations For Irs Collections Brotman Law

Does The Irs Forgive Tax Debt After 10 Years

Does The Irs Forgive Tax Debt After 10 Years

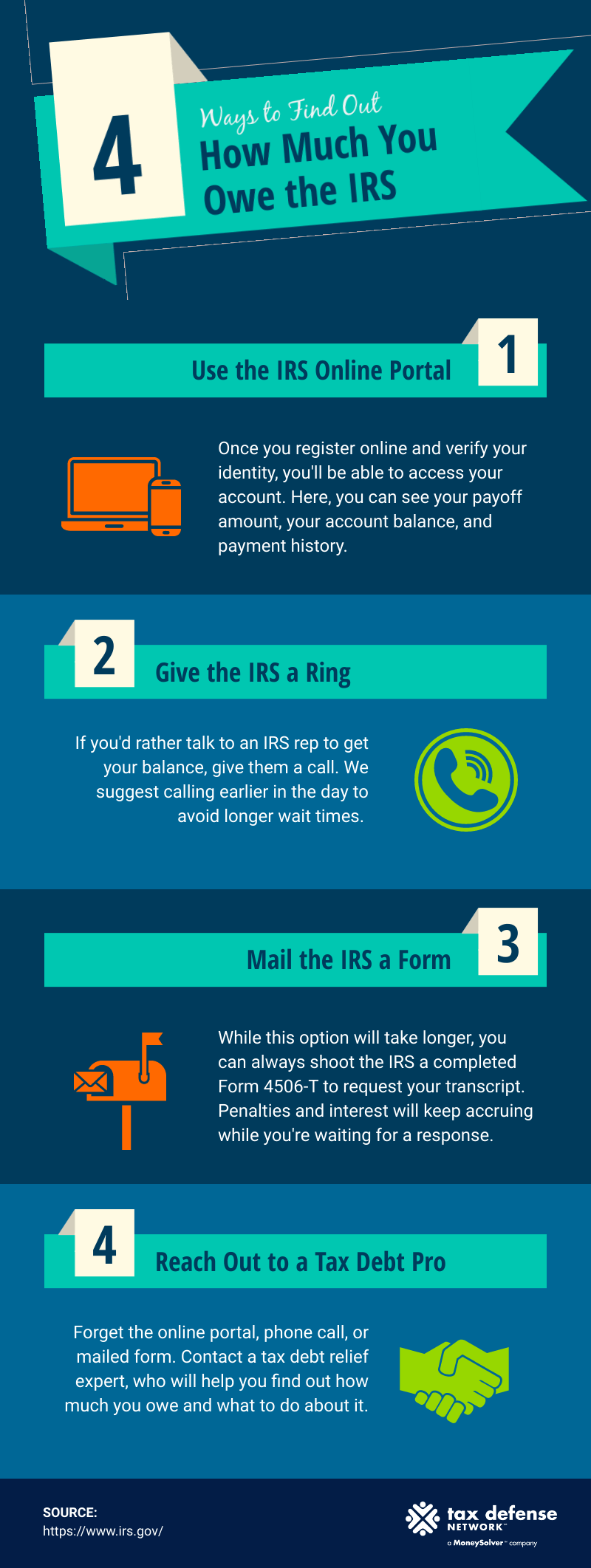

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

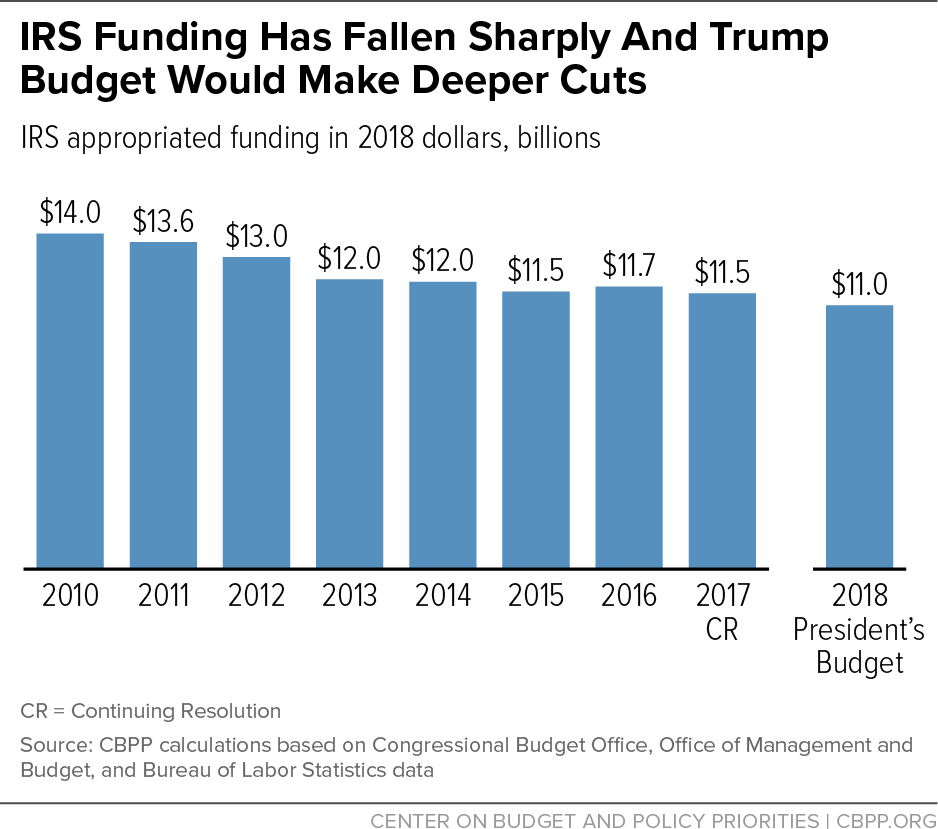

Trump Budget Continues Multi Year Assault On Irs Funding Despite Mnuchin S Call For More Resources Center On Budget And Policy Priorities

How The Irs Was Gutted Propublica

Orange County S Trusted Irs Tax Attorney Semper Tax Relief

Does Irs Debt Show On Your Credit Report H R Block

Irs Statute Of Limitations From Community Tax Resolution

The Top 10 Consequences Of Tax Debt H R Block

If You Have Tax Debt Here Are 5 Tips To Set Things Right With The Irs